federal estate tax exemption 2022

The assets may include real estate cash stocks or other valuable items. The types of taxes a deceased taxpayers estate can owe are.

Federal Estate Tax Exemption And Top Rates Throughout History Since 1916 Your Personal Cfo Bourbon Financial Management

24120000 for a Married Couple.

. For 2022 the threshold for federal estate taxes 1206 million for individuals and 2412 million for married couples. TCJA increased the exemption amount in tax year 2018 from 549 million to 1118 million. 12060000 for an Individual.

The Estate Tax is a tax on your right to transfer property at your death. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. The Tax Cut and Jobs Act Pub.

The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12060000 to 12920000. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. Married couples in this situation may.

Understand the Unified Tax Credit and the Upcoming Changes. In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31. Gift and Estate Tax Exemption.

Each year since this amount has been increasing with inflation but the exemption amounts. The first 1206 million of your estate is therefore exempt from taxation. The US charges FET on all the assets in a deceased persons estate if that person was a US citizen held a US passport or a US green card on the date of death once the value of the.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. For people who pass away in 2022 the exemption. For 2023 this limit jumps to 1292 million for individuals and 2584.

California Estate Tax in. Those who have used up their lifetime exclusions as of December 31 2022 will now be able to gift another 860000 tax-free starting January 1 2023. A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000.

Several exemptions can reduce or. As the table below shows the first 1 million is taxed at lower rates from 18 to 39. Federal Estate Tax Exemption 2022 Federal Estate Tax Exemption in 2022.

Your estate wouldnt be subject to the federal. Each spouse gets an exemption so married couples can pass 2412 million before owing any. However the deductible cannot be more than 7400 up 250 from the limit for.

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. Starting in 2023 individuals can transfer up to 1292 million to heirs during life or at death without triggering a federal estate-tax bill up from 1206 million in 2022. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021.

The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in. The 2022 exemption is 1206 million up from 117 million in 2021. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021.

For tax year 2022 for family coverage the annual deductible is not less than 4950 up from 4800 in 2021. Estate Tax Exemption goes up for 2022. Their federal estate tax exemption.

Your first 1206 million passes tax-free called your federal estate tax exemption. The New York estate tax is a tax on the transfer of assets after someone dies. For step-by-step instructions on securing an estate tax transcript access Transcripts in Lieu of Estate Tax Closing Letters on IRSgov.

Estate Tax Exemption goes up for 2022. The current estate tax exemption is 12060000 and double that amount for married couples.

Your Estate Plan Don T Forget About Income Tax Planning Cordasco Company

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Faq What Are The Federal Maryland D C And Virginia Estate And Gift Tax Exemptions For 2022 Paley Rothman

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Where Not To Die In 2022 The Greediest Death Tax States

Bob Nennig On Linkedin Estateplanning Lifeinsurance Financialplanning

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Federal And State Estate Law Tax Changes In 2022

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Federal Estate Tax And Gift Tax Limits Announced For 2022

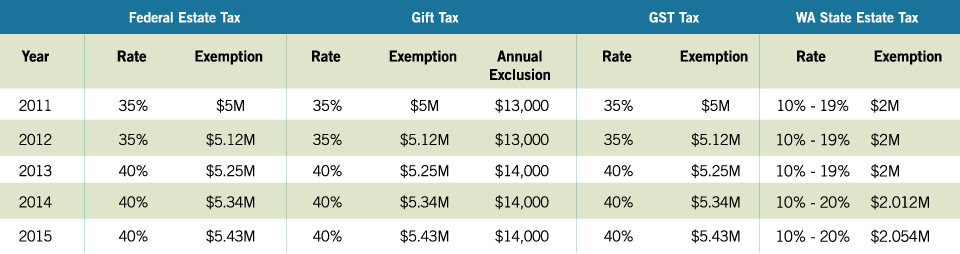

2015 Estate Planning Update Helsell Fetterman

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj